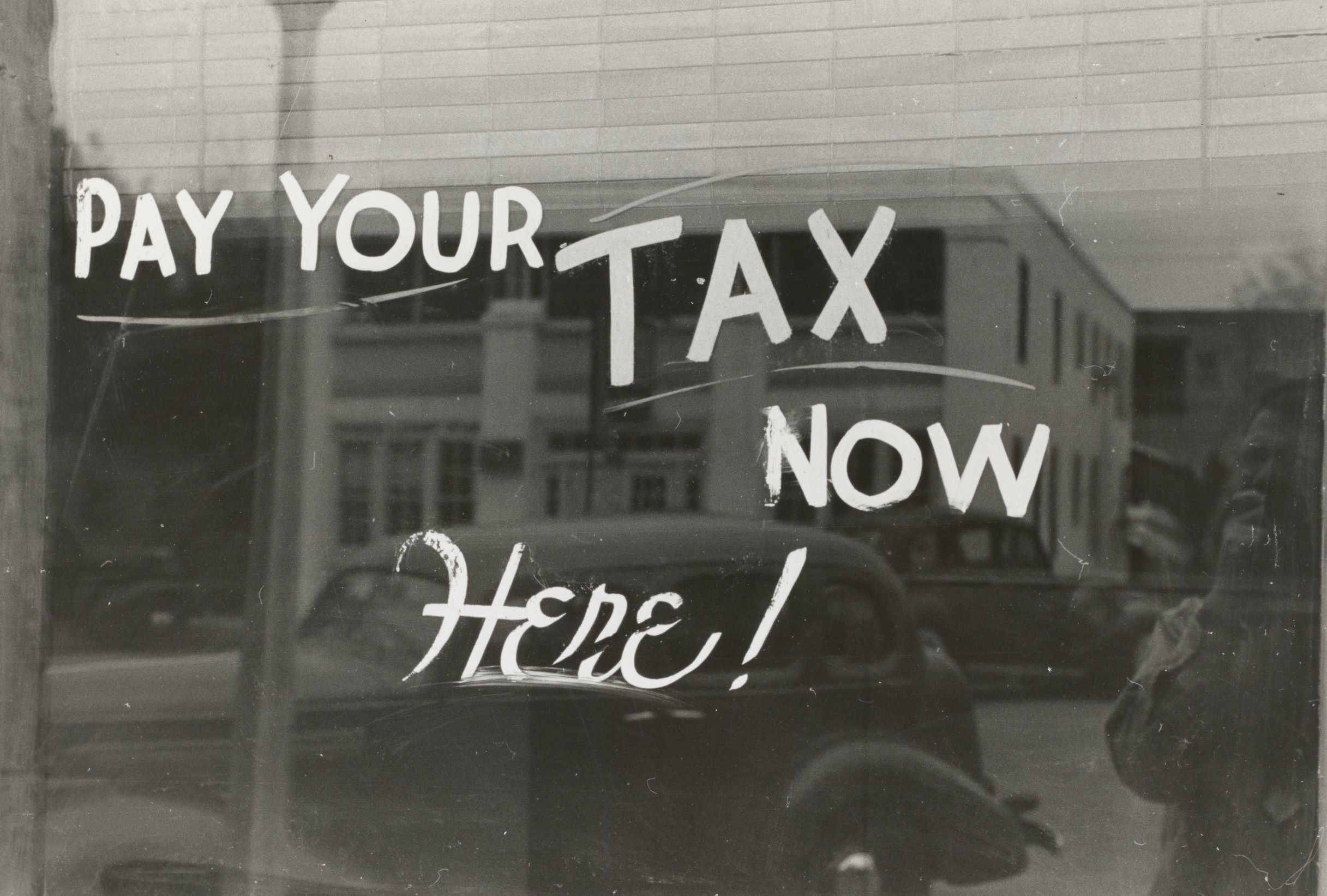

What actions should I take at the start of the 25/26 tax year?

When the new tax year rolls around, many of us breathe a sigh of relief; last year’s tax affairs are sorted. But this isn’t just a time to relax; it’s also the ideal moment to prepare for the tax year ahead. Being proactive at the start of the tax year can significantly reduce your tax

Read more