My earnings mean I lose Government help with my childcare. What can I do?

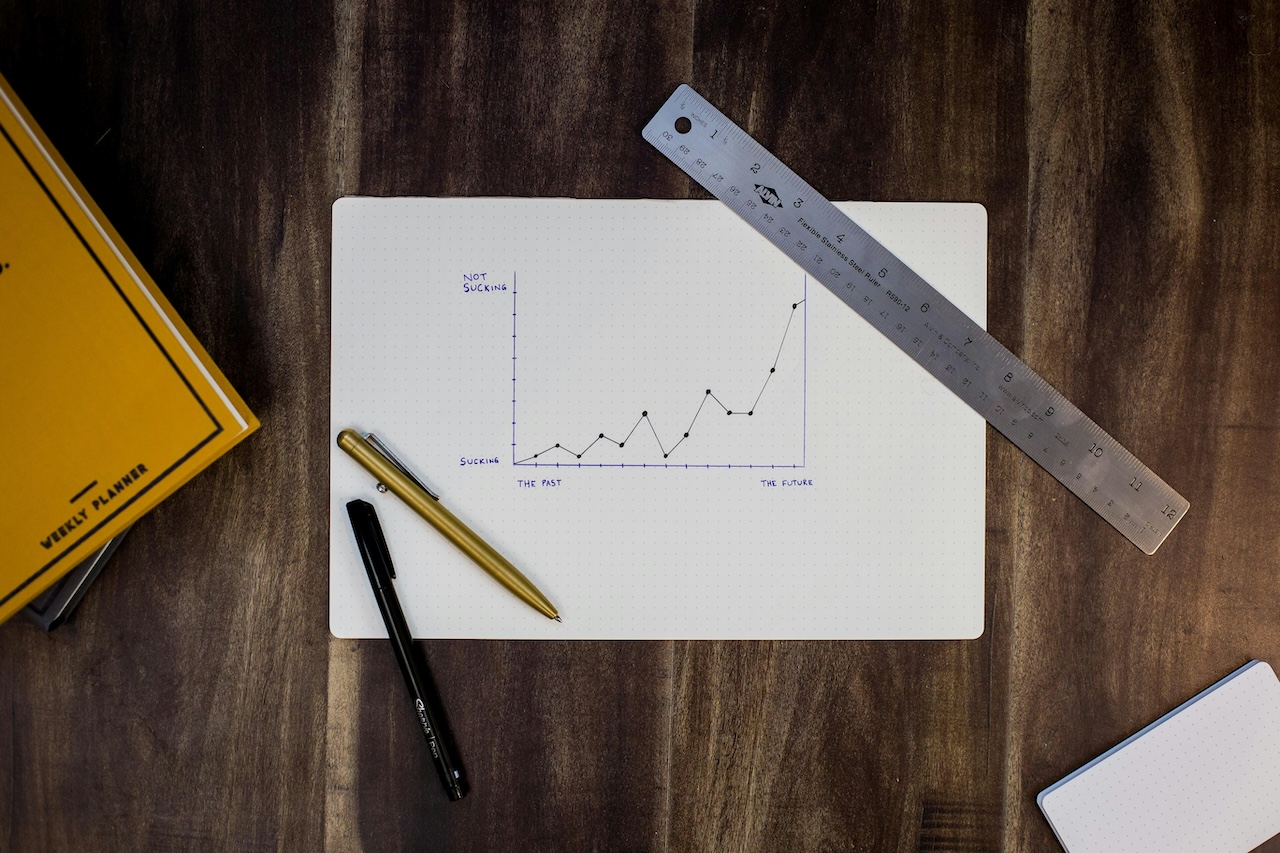

Productivity experts suggest that sometimes you have to do less to get more. This is something that equally applies to high earners who paying for childcare. Earnings and Childcare According to the UK government, nearly one million people in the UK earn between £75,300 and £96,400, most of whom are over 35.[1] At first glance,

Read more